This article does a good job of explaining the basics of trading and one of The Most Profitable Trading Strategies. It highlights the importance of understanding your personal goals and risk tolerance before developing specific strategies.

This article does a good job of explaining the basics of trading and one of The Most Profitable Trading Strategies. It highlights the importance of understanding your personal goals and risk tolerance before developing specific strategies.

Exploiting Market Volatility

Introducing a trading strategy focusing on market volatility rather than prediction is an innovative approach. Volatility-based strategies can be advantageous, especially in markets with frequent price fluctuations. This method recognizes the inherent unpredictability of the market and seeks to leverage the natural ups and downs for profit.

Crafting a Profitable Trading Strategy

Many people want to make a lot of money from trading. But the stock market is complicated and it’s hard to always make money. Even though it’s difficult to get rich quickly from trading, having a good plan can help you make more money over time.

Building a Personalized Trading Foundation

It’s important to know how much risk you’re comfortable taking, how long you plan to invest your money, and what you want to achieve with your investments. Whether you want to make a lot of money quickly, get a steady income, or a mix of both, you need a plan. This plan should be based on studying how the market works, using charts or company information to make decisions. It’s also helpful to test your plan using past data to see how it would have worked.

Risk and Exploring Trading Strategies

It’s important to manage your money carefully when trading. You should decide how much money to invest in each trade, set limits on how much you can lose, and spread your investments across different things. Putting all your money into one investment is risky.

There are many different ways to trade. Some people try to make money when prices are going up, while others make money when prices go back to normal. Some traders try to make quick profits by buying and selling stocks quickly, while others hold stocks for a longer time.

The Human Factor in Trading

To be successful in trading, you need a good plan, emotional control, and the ability to stick to your plan. Even though past results don’t guarantee future success, having a solid plan and managing your money well can help you make money over the long term. Remember, making money from trading takes time and patience.

The Three Most Profitable Forex Trading Strategies

The article does a good job of explaining different ways to trade:

- Trend trading: Making money when prices are going up or down for a long time.

- Mean reversion trading: Making money when prices go back to normal after changing a lot.

- Momentum trading: Making money when prices are moving quickly up or down.

- Scalping and day trading: Making quick money by buying and selling stocks quickly.

Bali Scalping Strategy: A Brief Overview

The Bali Scalping strategy is a way to make quick money by trading currencies. It focuses on small price changes that happen very quickly.

To use this strategy, you need to look at very short-term charts, like those for one or five minutes. You also need to set very close limits for when to sell if the price goes down (stop-loss) and when to sell if the price goes up (take-profit).

This strategy is about making many small profits, even if you lose some trades. It’s important to understand how the market works on a very detailed level to use this strategy successfully.

Remember, there are many different ways to use the Bali strategy, so it’s important to find what works best for you.

Fight the Tiger Candlestick Strategy

The Fight the Tiger strategy is one of The Most Profitable Trading Strategies and is a way to trade currencies by looking at how prices move over time. It’s based on the idea that after a big price change, the price might go back in the other direction.

This strategy looks at how prices move over a whole week to find big price changes. It then uses special chart patterns to decide when to buy or sell. Traders who use this strategy often hold their trades for several days.

This strategy looks at how prices move over a whole week. It uses special shapes on the chart called candlesticks to find times when the price might change direction. Traders who use this method often hold their investments for several weeks.

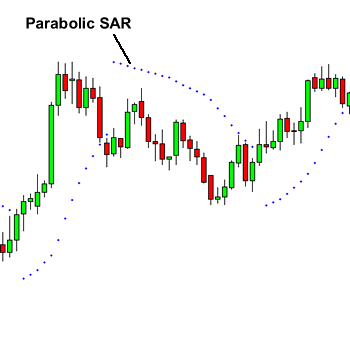

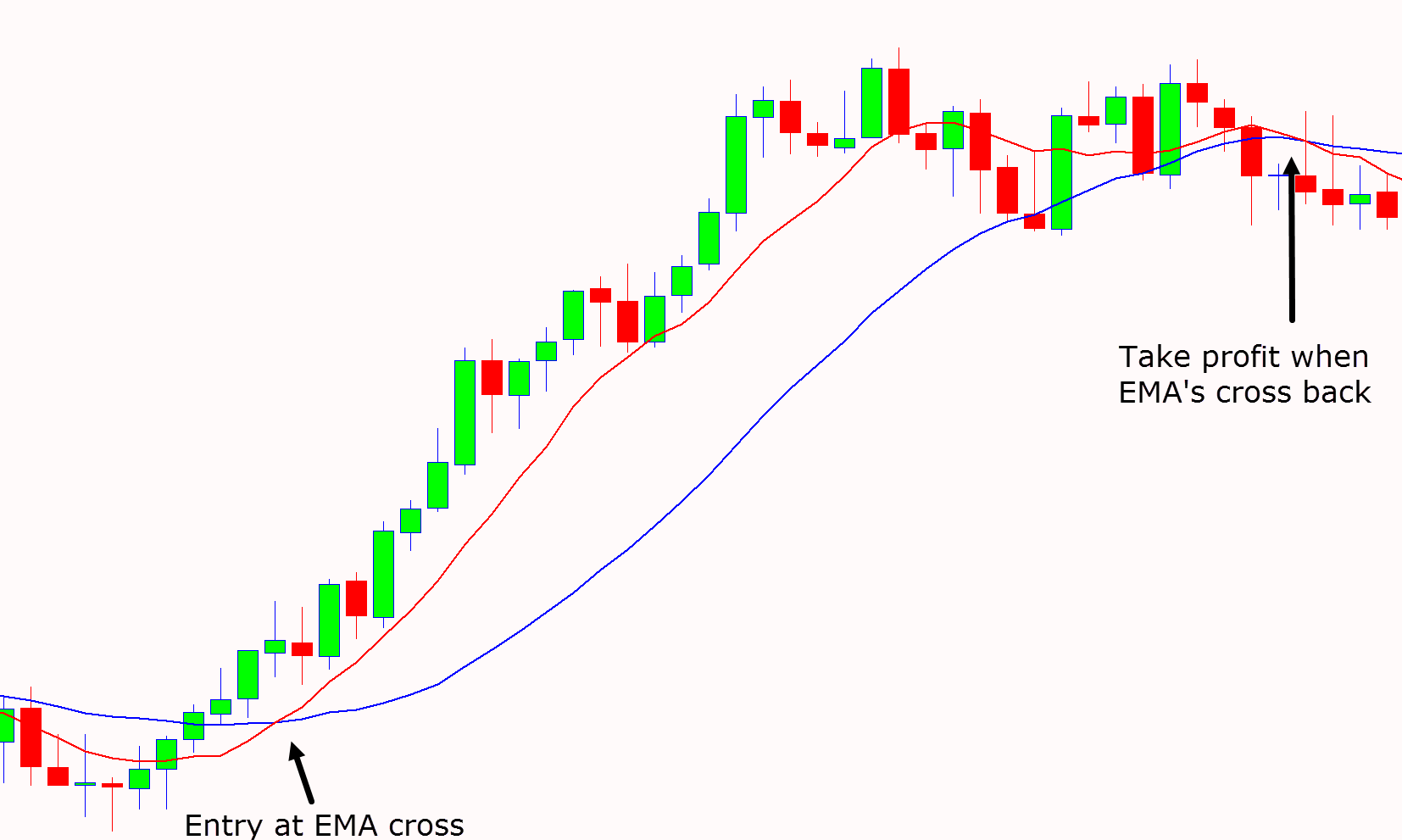

Profit Parabolic Trading Strategy: A Moving Average Approach

The Profit Parabolic strategy is a way to make money when prices are going up or down. It uses a simple average of past prices (moving average) to see which way the price is moving. It also uses a special tool called a Parabolic Stop and Reverse to decide when to buy or sell.

This strategy helps you follow the trend and protect your money by setting automatic stop-loss points.

Key elements of the Profit Parabolic strategy often include:

- Trend identification: A moving average, such as the 200-day or 50-day simple moving average, is commonly used to determine the overall trend direction.

- Parabolic SAR: This indicator is used to set stop-loss levels and potentially reverse the position when the trend changes.

- Risk management: Proper position sizing and stop-loss placement are crucial to protect capital.

The Bottom Line: The Most Profitable Trading Strategies

To be a good trader, you need to plan carefully, follow your plan, and control your emotions. Even though it’s not easy to always make money, having a good plan and managing your money well can help you do better over time.