Volatility Currency Pairs:

Volatility is like how much a currency’s price goes up and down. If it’s high, the price can change a lot, which means you could make more money or lose more money. If it’s low, the price stays pretty steady, so you might make less money but also lose less.

Three Key Points:

Three essential points to include in the introduction of your article on currency volatility:

- Explain volatility: Tell your readers what volatility means in trading. It’s like how much a currency’s price goes up and down.

- Why it’s important: Explain why understanding volatility is helpful. It can help you make better trading choices, take less risk, and potentially earn more money.

- What to expect: Give your readers a quick idea of what the article will cover. Talk about things like what makes currencies change in price, different levels of volatility, and how to trade when prices are moving a lot or a little.

Meaning

Volatility is like a mood swing tracker for investments. It shows how much the price of a stock, currency, or other asset goes up and down over time. Imagine a bumpy rollercoaster ride for high volatility and a smooth, calm train ride for low volatility.

- High volatility: Prices bounce around a lot, which can mean bigger potential gains but also bigger potential losses.

- Low volatility: Prices stay fairly steady, so profits might be smaller but the risk is lower.

Knowing the volatility of an investment helps you understand how risky it is. It’s also important for figuring out the price of options contracts, which are financial tools based on future price movements.

What Affects Currency Prices?

However, several things can make the value of a currency go up or down:

- Economy News: Reports about jobs, how much things cost (inflation), and how well the economy is doing can affect currency prices.

- Politics: Things like wars, elections, and trade disagreements can also change currency values.

- Central Bank Decisions: When banks that control money decide to change interest rates, it can impact currency prices.

- Investor Feelings: What people think about the economy and the future can influence how much a currency is worth.

Currency Pairs with Less Price Change

Currency pairs with low volatility: Some currency pairs tend to have smaller price swings. These can be a good choice if you prefer a calmer market:

- Euro and British Pound (EUR/GBP): Both countries have big economies that don’t change much.

- New Zealand Dollar and US Dollar (NZD/USD): While New Zealand’s economy can be affected by things like the price of goods, its value doesn’t change too much compared to the US dollar.

- Euro and Swiss Franc (EUR/CHF): Switzerland is known for a stable economy, so the Swiss Franc doesn’t change in value very often.

Strategies for Trading Low Volatility Currency Pairs

Longer-Term Horizons: Because these pairs don’t change much in price, it’s usually better to hold them for a longer time.

Fundamental Analysis: Look at things like how much the economy is growing, how much things cost (inflation), and how much interest rates are. This can help you find good times to buy or sell.

Technical Analysis: Even though these pairs don’t move a lot, you can still use charts and patterns to find good buying and selling points.

Scalping and Day Trading: These are strategies where you buy and sell quickly. While it’s not as common with low-volatility pairs, it can still work, especially when prices are moving faster.

Advantages of Trading:

So, trading currency pairs that don’t change in price much has its perks:

- Lower Risk: Smaller price swings mean less chance of losing money.

- Steady Profits: While profits might be smaller, they tend to be more reliable.

- Perfect for Cautious Traders: These pairs are a good fit if you prefer a calmer trading environment.

Big Price Changes

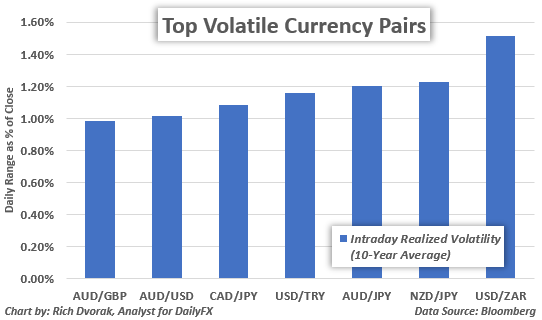

Trading Currency Pairs with big price swings can be thrilling, but it’s important to understand the risks.

- Finding Exciting Pairs: Look for currency pairs with a history of big price changes.

- Using Trading Tools: Tools like Bollinger Bands and RSI can help you predict when prices might go up or down.

- Quick Trading: Fast-paced styles like scalping or day trading can work well in these markets.

- Protecting Your Money: Always set limits on potential losses with stop-loss orders.

Feeling Out the Market: Measuring Volatility of Currency Pairs

How to Tell How Much a Currency Changes

There are two ways to figure out how much a currency’s price goes up and down:

- Looking at past prices: You can see how much the price changed in the past to guess how much it might change in the future.

- Listening to what other traders think: You can look at how much people are willing to pay for options to see what they think will happen to the price.

By using both ways, you can get a better idea of how much a currency might change.

How to Trade Low and High Volatility Currency Pairs

Currency pairs with low volatility: Currencies pairs offer a calmer trading environment, but require a different approach:

- Bigger Trades: To make good profits, you might need to buy or sell larger amounts of currency.

- Careful Borrowing: Using borrowed money (leverage) can increase your potential returns, but also your losses.

- Long-Term Focus: These pairs often work better for traders who look at the bigger economic picture.

- Seizing Opportunities: Watch for times when the price suddenly moves out of its usual range.

Thriving in the Fast Lane: High Volatility Pairs

High-volatility currency pairs can be exciting, but they also come with increased risk. To succeed, you’ll need:

- Market Insights: Use tools like Bollinger Bands and RSI to predict short-term price changes.

- Protect Your Money: Set strict limits on potential losses with stop-loss orders.

- Act Fast: Be ready to make quick decisions and place orders to capture fleeting opportunities.

- Short-Term Focus: Scalping or day trading strategies can work well in these fast-paced markets.

- Leverage Volatility: Options trading can be a way to profit from price swings without predicting the exact direction.

The Bottom Line

Understanding how much currency prices go up and down is important for successful trading. Steady markets are less risky but can be harder to make big money in. Markets with bigger price swings offer chances for bigger profits, but you need to be careful not to lose money.

So, the best way to trade depends on how much risk you like and what you hope to achieve. It’s smart to learn about trading and maybe ask an expert for help.