Mastering the art of trading with the least volatile forex pairs. Currency prices constantly go up and down. Some currencies change prices a lot, while others don’t change as much. If you want to trade without too much risk, you should look at currencies that rarely change price.

What is Volatility in Forex?

How much a currency’s price goes up and down is called volatility. When a currency’s price changes quickly, it’s very volatile. If it doesn’t change much, it’s not very volatile. Things like news about the economy can make prices change more or less.

The Least Volatile Forex Pairs: A Measure of Market Volatility

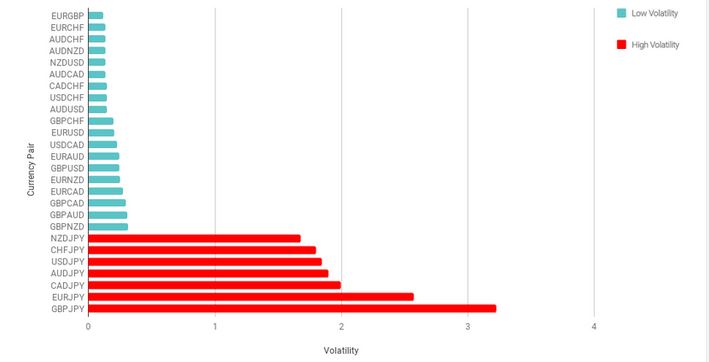

ATR stands for Average True Range. It’s a technical analysis indicator that measures market volatility. In simpler terms, it shows how much a price typically moves in a given period of least volatile forex pairs.

- How does it work?

- It calculates the average price movement over a specific number of periods (usually 14 days).

- Higher ATR values indicate higher volatility, meaning prices fluctuate more.

- Lower ATR values suggest lower volatility, with prices moving within a tighter range.

- Why is it important?

- Helps traders understand market conditions.

- Can be used to set stop-loss and take-profit levels.

- Assists in determining potential entry and exit points.

ATR tells you how much a price usually moves. It’s like measuring how far a rollercoaster goes up and down.

When the ATR number is big, the price moves up and down a lot. When the ATR number is small, the price doesn’t move much.

Knowing the ATR can help you decide when to buy or sell, and how much you might lose if the price goes down.

What Makes a Currency Pair Volatile?

What makes currency prices change a lot?

- Economy news: When good or bad things happen to a country’s economy, the price of its currency can change quickly.

- Problems in the country: If a country has political problems or wars, its currency price can change a lot.

- How people feel about the economy: If people think the economy will do well, the currency price might go up. If they think it will do badly, the price might go down.

- How much people buy and sell: When a lot of people buy or sell a currency, the price can change quickly.

The Least Volatile Forex Pairs

While the forex market is known for its dynamic nature, some currency pairs exhibit relatively lower volatility. So, these pairs can offer traders a more stable trading environment, allowing for focused strategies and reduced risk. For further information about AI Trading Secrets, click on this link.

Key factors influencing low volatility:

- Strong and stable economies: Countries with robust economic foundations tend to have currencies with less dramatic price fluctuations.

- Low political risk: Political stability contributes to a calmer market environment.

- High liquidity: Currency pairs with substantial trading volumes often experience smoother price movements.

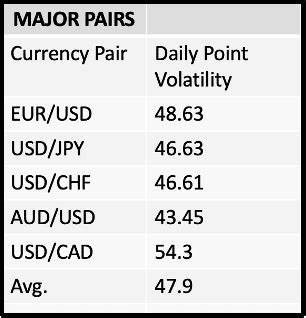

Generally, least volatile forex pairs involving major economies with stable political and economic conditions tend to exhibit lower volatility. Here are some of the typically less volatile pairs:

- EUR/USD: The Euro and US Dollar are two of the world’s most traded currencies, and their pair often displays relatively stable price movements.

- USD/JPY: The Japanese Yen is often considered a safe-haven currency, which can contribute to lower volatility in this pair.

- USD/CHF: Similar to USD/JPY, the Swiss Franc is seen as a safe-haven currency, leading to a generally calmer pair.

- GBPUSD: Despite the UK’s political landscape, the GBP/USD pair has historically shown less volatility compared to some other pairs.

Why Trade Less Risky Currencies?

Trading currencies that don’t change price much has a lot of benefits:

- Less chance of losing money: When prices don’t change a lot, you’re less likely to lose money quickly.

- Easier to see trends: It’s easier to figure out if the price will go up or down when it doesn’t change too much.

- Less stress: Trading can be stressful, but it’s easier when prices don’t move around a lot.

- Steady growth: If you want to make money slowly and steadily, these currencies are a good choice.

What to do with less risky currencies:

- Borrow money in one currency and invest in another: This is called a carry trade and works well when interest rates are different.

- Buy and sell currencies to make quick profits: This is called swing trading and can work well with currencies that don’t change price too much.

- Hold onto currencies for a long time: If you want to invest for a long time, these currencies can be a good choice.

Important Considerations About Least Volatile Forex Pairs

Even currencies that don’t change price much can change sometimes. It’s important to remember that things can change quickly in the market.

Some people like big changes, while others like small changes. It’s important to choose currencies that match how you like to trade.

Don’t put all your money in one place. It’s a good idea to buy different currencies to protect your money if one currency starts to lose value.

Keep an eye on the news: Things that happen in the world can change currency prices, so it’s important to stay informed.

By understanding the factors influencing volatile forex pairs and focusing on historically less volatile pairs, traders can create a more stable trading environment. However, it’s crucial to continuously monitor market conditions and adjust trading strategies accordingly.

Bottom Line

Trading currencies can be exciting, but it’s important to choose the right ones. So, some currencies change prices a lot, which can be risky. However, others don’t change as much, which is safer. By picking the right currencies, you can make money without taking big risks.