MetaTrader 5 (MT5) is a popular trading platform that individuals and brokers use. Its user-friendly interface and robust features make it a valuable tool for navigating the financial markets. This article will guide you through the essential steps of using MT5, from setup to placing your first trade.

Getting Started To Use MetaTrader 5

Before you jump into trading, you’ll need to get MT5 set up. Here’s how:

- Grab MT5: Head over to your chosen broker’s website and download MT5. It should be free and easy to find.

- Install MT5: Once you’ve downloaded the file, run it to install MT5 on your computer. The installation process is usually quick and straightforward.

Practice Makes Perfect: Demo Accounts

Once MT5 is installed, you can launch it and log in using your broker’s credentials. If you’re new to trading, don’t worry about using real money right away! Most brokers offer demo accounts that let you practice using virtual money. This is a great way to get comfortable with MT5 and test out your trading strategies before risking real cash.

Understanding the Interface

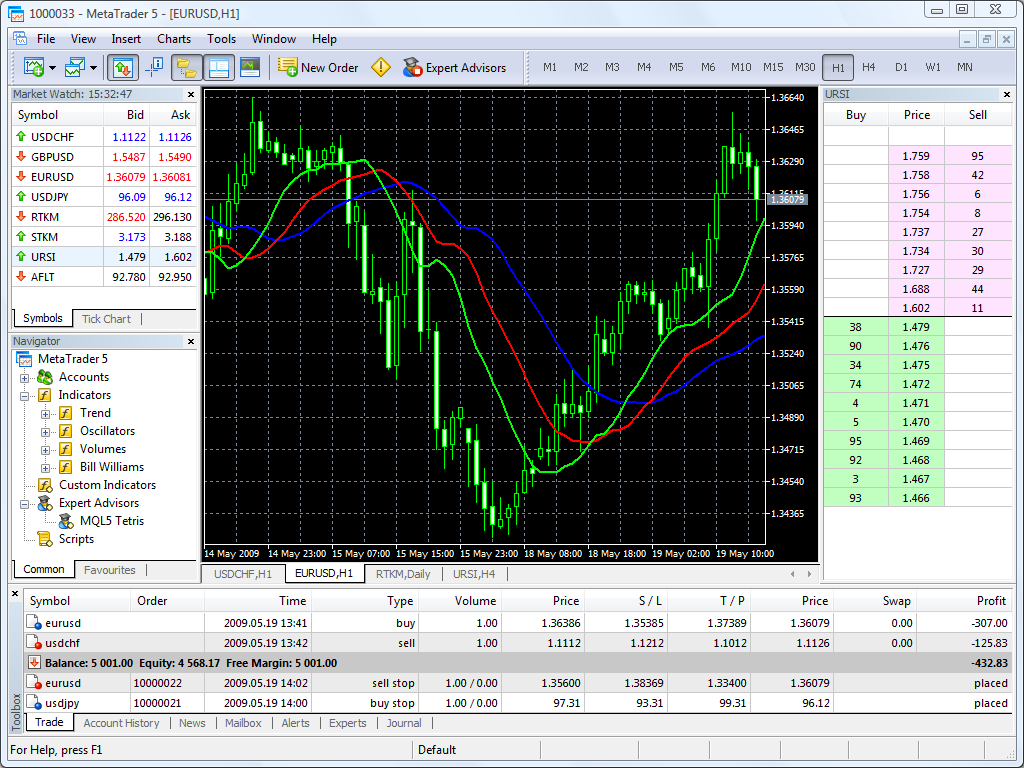

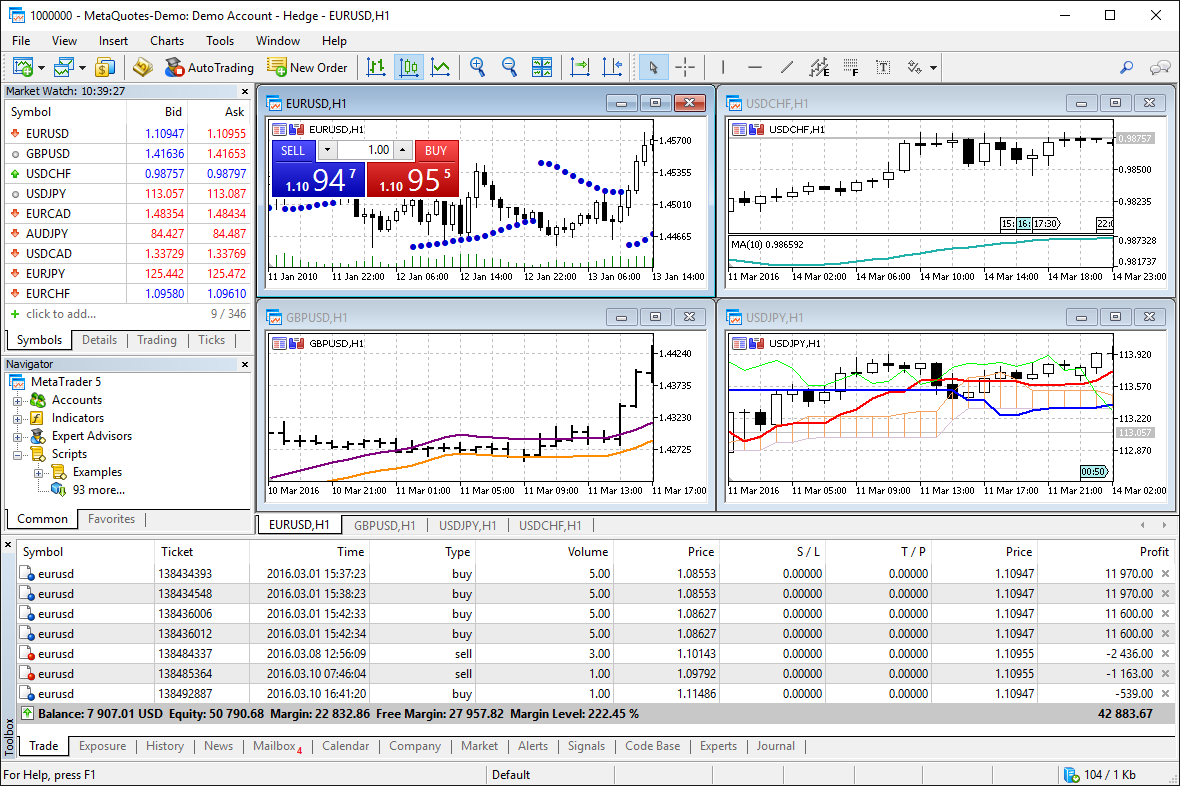

MT5’s interface is designed for efficiency. So, here’s a quick rundown of the key elements:

-

Market Watch: This section displays real-time quotes for your chosen financial instruments. You’ll also see the latest price statistics (spread, volume, etc.), a small price chart, contract specifications, and the ability to initiate one-click trading.

-

Navigator: This section acts as a library for all your technical MetaTrader 5 Forex analysis tools and algorithms, also known as Expert Advisors (EAs) and indicators. The Navigator allows you to manage them easily, switch between accounts, and run EAs and indicators directly.

-

Charts: MT5 features advanced charting functionalities with 21 timeframes to support any trading strategy. You can visualize changes in Forex pairs, stocks, and other financial assets at a glance and respond accordingly. Charts can also be customized with technical indicators and drawing tools to identify trading opportunities.

-

Terminal Window: This window provides an overview of your account activity, including open positions, trade history, and account balance.

Customizing Your Workspace: The Toolbar

The toolbar in MT5 is like your personal shortcut box. It lets you quickly access the tools you use most often, so you don’t have to waste time hunting through menus.

So, you can customize the toolbar to fit your trading style!

- Pick Your Tools: Drag and drop buttons to add or remove functions from the toolbar. This way, you can keep the tools you use all the time close at hand.

- Organize Your Toolbox: Group similar functions together on the toolbar. This keeps things neat and makes it easier to find the tool you need when you need it.

By customizing the toolbar, you can create a workspace that feels comfortable for you. This will help you trade more efficiently and get the most out of MT5.

Placing Your First Trade

So, once you’ve analyzed the market and found a potential opportunity, it’s time to place your trade in MetaTrader 5. Here’s how:

- Open the Order Window: There are a few ways to do this. You can click the “New Order” button on the toolbar, right-click on an instrument in the market list (Market Watch), or use the buy/sell buttons directly on the charts (if you’ve enabled them).

- Tell MT5 What to Do: In the order window, you’ll choose a few things:

- What to Trade: Pick the instrument you want to buy or sell (like a currency pair).

- How Much: Indicate how much you want to trade (usually shown in lots).

- When to Trade: Decide if you want to buy/sell right away (market order) or at a specific price (pending order).

- Limit Your Risk: Set stop-loss and take-profit levels to automatically close your trade if the price goes against you or reaches your profit target.

- Buy or Sell: Once you’ve filled in everything, click the “Buy” or “Sell” button to make your trade happen.

Decoding the Market with MT5 Technical Analysis

However, MetaTrader 5 goes beyond just showing prices. It equips you with a toolbox for technical analysis, a method for spotting potential trading opportunities. Imagine these tools as special lenses that help you see patterns and trends in price movements.

MT5 Technical Toolbox:

- Indicators: These are like mathematical formulas that analyze price data and generate signals. However, popular examples include trend indicators (like moving averages) and momentum indicators (like RSI).

- Graphical Objects: Lines, channels, and shapes can be drawn on the charts to highlight potential support and resistance levels, or to identify price patterns like triangles or head-and-shoulders.

Combining Tools for Stronger Signals:indi

Looking at just one clue (indicator) to decide a trade can be tricky, like trying to solve a puzzle with missing pieces. In MT5, you can use several hints together to get a clearer picture.

For example, imagine the price for something you want to trade jumps sharply (breaks out). That might seem like a good sign, but hold on! In MT5, you can check if there’s also a big increase in buying or selling activity (volume). If there’s not much activity, the price jump might not be as strong.

MT5 Has Tools for Everyone:

No matter your trading style, fast or slow, MetaTrader 5 has tools to help you make smarter choices.

Technical Indicators in MT5:

Pips: The Smallest Price Change in Forex

In the world of forex trading, prices are quoted in tiny increments called pips. Pip stands for “percentage in point” and represents the smallest measurable change in a currency pair’s exchange rate.

MT5 isn’t just about seeing prices – it has special tools to help you understand what’s happening in the market. So, these tools, called indicators, are like hints that can help you:

- See if prices are trending up or down

- Figure out if the market is getting hot or cold (overbought or oversold)

Indicator Goodies in MT5:

There are many indicators already built into MetaTrader 5, like:

- Moving Averages (MA): This smoothes out price bumps and dips, making it easier to see the overall trend.

- Relative Strength Index (RSI): This gauges how strong recent price movements are and can warn you if the market might be getting overexcited (overbought) or overly cautious (oversold).

- Bollinger Bands: These create lines around the price that widen when things are shaky and tighten up when things are calm. So, they can help you identify when prices might make bigger moves.

- MACD: This combines two moving averages to show you changes in momentum and potentially signal when trends might be shifting.

The Bottom Line of MetaTrader 5:

MetaTrader 5 offers a user-friendly platform with powerful tools for traders of all experience levels. By familiarizing yourself with the Market Watch, Navigator, Charts, and Toolbar, you can efficiently analyze markets and execute trades.